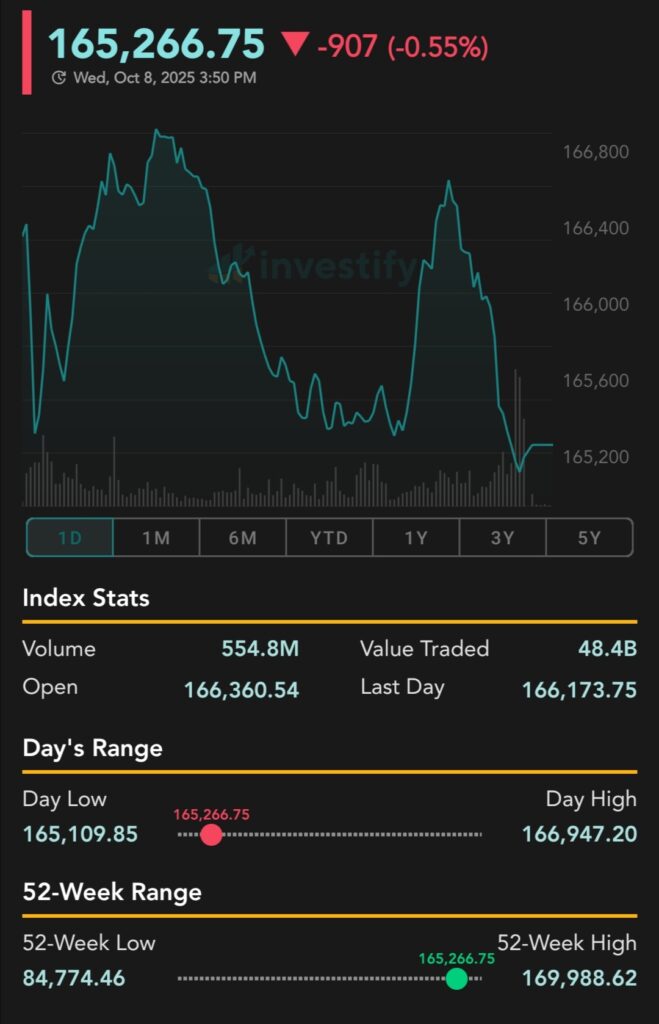

The Pakistan Stock Exchange (PSX) witnessed a negative closing today, with the benchmark KSE 100 Index pulling back from its recent highs. The index shed 907 points, a drop of -0.55%, to close the session at 165,266.7. This movement signals a phase of profit-taking after the index’s strong performance, reflecting investor caution.

Key Trading Highlights

Today’s trading activity at the Karachi Stock Exchange was marked by a notable increase in trade value, despite the overall negative close.

Final Close: 165,266.7

Point Change: -907 points

Percentage Change: -0.55%

Trade Volume: A substantial 554.8 million shares were traded, indicating high market participation.

Trade Value: The total value of shares traded reached Rs. 48.38 billion, underscoring significant institutional and retail activity.

Intraday Range: The index traded within a wide range, hitting a low of 165,110 and an intraday high of 166,947.

What Drove the Sell-Off?

The day’s decline suggests a pause in the market’s recent bullish trend. Analysts attribute the sell-off primarily to:

Profit-Taking: Investors capitalized on the index’s recent rally, leading to selling pressure in blue-chip stocks.

Consolidation: The market appears to be entering a consolidation phase, which is a normal and healthy adjustment after a period of sharp gains.

Investors should monitor key economic indicators and corporate announcements in the coming days for signals on the index’s next direction. For long-term investors, market dips often present a potential buying opportunity in fundamentally strong stocks. Stay informed and consult your financial advisor before making investment decisions.

Be First to Comment